Revolutionizing the Insurance Industry with Digital Transformation

Introduction

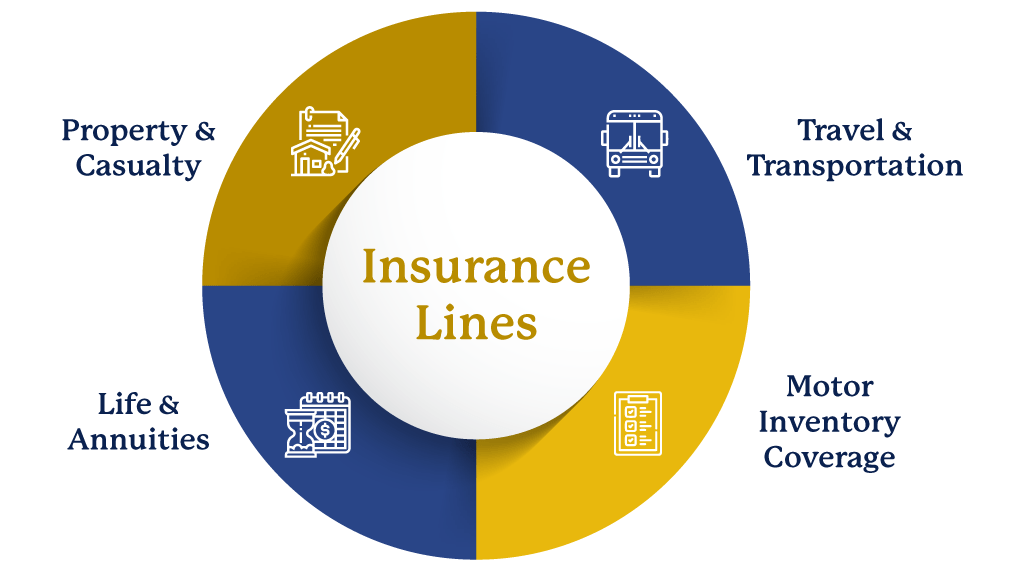

The insurance industry is one of the most tradition-bound yet rapidly evolving sectors in the world. From life and health insurance to property, casualty, and specialty products, insurers have historically relied on manual processes, intermediaries, and paper-heavy operations. But today, customer expectations, regulatory environments, and competitive pressures are driving the industry to embrace technology-led transformation.

Modern policyholders demand instant quotes, seamless claims processing, transparent policies, personalized coverage, and mobile-first experiences. At the same time, insurers face rising risks from cyber threats, natural disasters, and rapidly changing market dynamics. To remain competitive, insurers must invest in digital platforms, data-driven insights, AI-powered underwriting, and secure customer engagement tools.

Intigate Technologies partners with insurers, brokers, and insurtech startups to deliver scalable, intelligent, and customer-centric digital solutions that streamline operations and create new revenue opportunities.

Key Challenges Facing the Insurance Industry

Despite its importance, the insurance sector grapples with several challenges:

-

Lengthy & Complex Processes – Policy issuance, underwriting, and claims often take days or weeks.

-

Rising Fraud & Risk Exposure – Fraudulent claims and cyber threats increase operational risks.

-

Customer Expectations – Clients demand instant quotes, 24/7 support, and seamless experiences.

-

Regulatory Compliance – Adhering to local and international insurance regulations is complex.

-

Data Silos – Legacy systems prevent efficient use of customer and claims data.

-

Low Customer Engagement – Most policyholders interact only at purchase or claim time.

-

Intense Competition – Insurtech startups and digital-first players are disrupting traditional insurers.

-

Product Innovation Needs – Customers seek tailored policies (e.g., pay-per-use auto insurance).

To thrive, insurers must leverage technology for efficiency, security, and personalization.

Technology Solutions Driving Insurance Innovation

The industry is being reshaped by digital innovations that simplify operations, reduce fraud, and improve customer experiences.

1. AI & Machine Learning in Underwriting and Risk Assessment

-

Predictive analytics for more accurate premium pricing.

-

Automated underwriting that reduces human bias and speeds up approval.

2. Robotic Process Automation (RPA)

-

Automating repetitive tasks such as policy issuance and compliance checks.

-

Reducing operational costs while improving accuracy.

3. Blockchain for Fraud Prevention & Transparency

-

Secure, tamper-proof records for policies and claims.

-

Faster validation of customer data across multiple stakeholders.

4. Telematics & IoT in Insurance

-

Usage-based auto insurance through real-time driving data.

-

Smart home devices reducing risks for property insurers.

5. Mobile & Web Portals

-

Self-service apps for policy purchase, renewal, and claims filing.

-

Omnichannel support for engaging customers anytime, anywhere.

6. Chatbots & Virtual Assistants

-

AI-powered support available 24/7 for queries, quotes, and claims.

7. Data Analytics for Personalized Products

-

Tailoring policies based on lifestyle, health, and behavioral data.

8. Cloud Computing

-

Secure, scalable infrastructure for managing millions of policies and claims.

Intigate Technologies’ Insurance Solutions

At Intigate Technologies, we design end-to-end digital insurance solutions that address modern challenges and create future-ready opportunities.

Our Offerings:

-

Custom Insurance Management Systems – Unified platforms for policy administration, claims, and compliance.

-

AI-Powered Underwriting Engines – Automated risk assessment with predictive analytics.

-

Claims Automation Solutions – Faster, paperless claims settlement with fraud detection tools.

-

Customer Self-Service Portals – Web and mobile apps for policy management, renewals, and support.

-

Telematics & IoT Integration – Usage-based insurance platforms for vehicles and smart homes.

-

Chatbots & Virtual Assistants – Personalized, 24/7 customer service.

-

Regulatory Compliance Automation – Tools to stay compliant with global insurance regulations.

-

Blockchain-Enabled Policy & Claims Management – Secure and transparent record-keeping.

-

Analytics Dashboards – Insights into customer behavior, claim trends, and fraud detection.

-

Cloud Migration Services – Scalable, secure infrastructure for modern insurers.

Real-World Use Case

Imagine a traditional health insurance company struggling with delayed claims and customer dissatisfaction. By partnering with Intigate:

-

AI-powered claim verification automates approvals, reducing processing time from weeks to hours.

-

Mobile app integration allows customers to check policy details, file claims, and track status.

-

Blockchain integration ensures all medical records and claim data are securely stored and verified.

-

Chatbots provide instant assistance, reducing call center load.

The insurer not only improves customer experience but also cuts operational costs, reduces fraud, and enhances trust in its brand.

Similarly, a motor insurance provider can integrate IoT-enabled telematics to offer usage-based premium models, appealing to younger, tech-savvy customers and opening new revenue channels.

Business Benefits of Digital Insurance Solutions

By adopting Intigate’s technology-driven solutions, insurers gain:

-

Faster Claims Processing – Improved efficiency and reduced settlement times.

-

Fraud Detection & Prevention – AI and blockchain to reduce fraudulent claims.

-

Higher Customer Retention – Better engagement and seamless digital experiences.

-

Cost Efficiency – Automation reduces operational overheads.

-

Data-Driven Decisions – Analytics for risk modeling, pricing, and customer segmentation.

-

Regulatory Compliance – Automated checks to meet evolving regulations.

-

New Revenue Models – Telematics, micro-insurance, and pay-per-use policies.

-

Scalability – Cloud-based platforms that grow with business needs.

Future of Insurance: What Lies Ahead

The insurance landscape is shifting rapidly toward customer-first, digital-first models. Future trends include:

-

Embedded Insurance – Policies integrated directly into customer purchases (e.g., travel booking apps).

-

On-Demand Insurance – Instant coverage for short-term or event-based needs.

-

AI-Powered Predictive Healthcare – Preventive policies based on health data and wearables.

-

Parametric Insurance – Automated payouts triggered by measurable events (e.g., weather conditions).

-

Metaverse Insurance – Coverage for digital assets and virtual properties.

-

Sustainable Insurance Models – Policies tailored for eco-friendly lifestyles and businesses.

Insurers that embrace these trends early will differentiate themselves and capture new market opportunities.

Conclusion

The insurance industry is undergoing a massive digital transformation driven by customer expectations, technological innovation, and competitive disruption. To thrive in this evolving landscape, insurers must adopt AI, blockchain, IoT, cloud computing, and analytics-driven platforms that improve efficiency, reduce risks, and enhance customer trust.

Intigate Technologies stands as a strategic partner for insurers seeking to modernize their operations, build scalable digital platforms, and deliver exceptional customer experiences. By leveraging our expertise, insurers can accelerate claims, personalize products, prevent fraud, and create innovative revenue streams.

For insurance companies, the future is not just about policies—it’s about delivering secure, personalized, and seamless digital experiences. With Intigate, insurers are not just adapting to change; they are shaping the future of insurance.